During the 2023 Global AgInvesting conference in New York in April, we talked about the rising cost of capital and valuations. Approximately 800 agriculture investment professionals from across the world attended the event. In 2024, we were pleased to be invited back to the conference to speak once again. David Gray, Conservis’ VP of Global Corporates delivered the closing comments.

Ag challenges & a volatility resurgence?

Volatility is a fact of life; all signs are that it will intensify as climate, politics and demand collide.

With this in mind, we started by summarizing some significant industry developments that had taken place since the 2023 conference. There are impending changes that are starting to be visible now that could have longer-term impacts on sector players. We began with some thoughts on yield compression, which is a way of looking at the price of an acre of farmland and the expected cash return on that farmland in a particular year. You can then divide the cash return on the cost per acre, leaving you with a cash rental yield.

US Midwest rental yield compression

Traditionally, overall yield on farmland is calculated on the basis of cash yield plus some amount of annual unrealized appreciation that’s inflation related.

Based on research from the University of Illinois, at an average cash yield of 2.78%, Illinois farmland, which is worth about $9,300 an acre today, is yielding less than a 12-month, or even a 5-year Treasury bond. Treasury bonds are the risk-free rate for the purposes of calculating your weighted average cost of capital (WACC). If the-free rate is 5%,then your WACC has to be in excess of that due to other factors that must be accounted for. Looking at the data today, the weighted average cost of capital for US farmers, including some debt, is going to be 8-9%. So the cost of capital is now much higher than even 3 years ago - and there is no realistic expectation that interest rates are likely to fall soon so this could be more of a structural change.

California land value weakness

- California land (Central Valley) values fell in 2023

- Tree nut prices are now about 75% lower than 2014

- SGMA changing the landscape and outlook

The second challenge lies largely in California where 15-20 agriculture industry bankruptcies have been filed in the past 12 months. Mostly this is a function of markets and prices: almond prices are about a quarter of what they were seven years ago, and the world is heavily over-planted. Moreover, the Sustainable Groundwater Management Act (SGMA) has now implemented a new framework for groundwater regulations, which has impacted growers of permanent crops in the state, in particular growers of tree nuts which require large amounts of water. Estimates are that roughly one in five almond growers in the state is in trouble today. This is meaningful because we’re talking high-value crops: California supplies 80% of the world’s almonds, according to NPR.

Food security danger

- No food security without free trade

- Prolonged wars in Gaza and Ukraine threaten shipping

- Climate threat and El Niño intensify risk

- Inflation: Competition for food impacts price and hungry voters reduce political longevity

- Policies and rhetoric increase interference in markets and generate farmer unrest

Four strategic objectives in ag are distinct from tactical choices

Asking yourself if your business model is resilient enough to cope with the change that’s coming may be a strong step in the right direction. Regenerative ag was a big topic within the conference this year. No doubt this is relevant but in reality this is a tactical choice which owners and farmers make as a means to achieve their strategic goals. Regardless of your tactical choices, having a grasp on farm performance and metrics is essential to set a business up for success.

- Money - scalability, market access, capital, profitability

- Markets - supply chains, pricing, trade

- Safety - organics, chemicals, biodiversity, people

- Environment - ESG, farming practices, nature positive, carbon

At the end of the day, the fundamental role of agriculture is to feed the world as nutritiously, safely and plentifully as possible. The question is, can you feed the world, hit these four strategic targets and still have enough flexibility around tactics? It seems clear that unless the underlying farming business is profitable, attainment of other objectives becomes impossible.

We encourage you to ask:

- How efficient are our operations now?

- Are we cultivating future leaders?

- Are we set up to make informed decisions?

- Are we employing best practices?

- How good/secure is our data?

- What operational/technology gaps do we have?

- Are we meeting/anticipating end-customer needs?

- How resilient are we financially?

- How robust is our risk management?

- Are we delivering for our stakeholders?

The looming data gap

Agriculture is becoming more and more data-intensive, reflecting both its core mission as a mass production industry whose purpose is to feed the planet and the impact of changing expectations across the wide universe of stakeholders. This data will not only be essential to gain access to markets: it will have significant incremental value as a tool to attract new capital and demonstrate track record and results. It will also underpin asset values and show achieved productivity improvements over time.

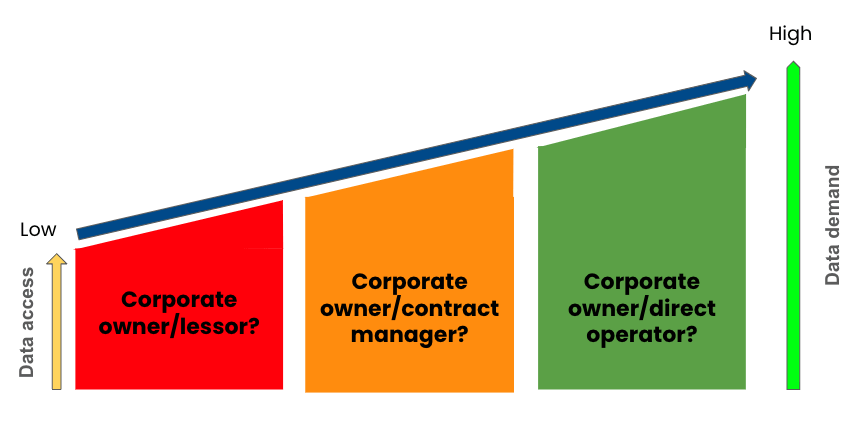

Data needs will challenge business models

In the world of corporate agriculture, there are 3 basic business models ranging from passive to more active.

- Information needs are changing the landlord/tenant relationship

- Data demands, yield compression challenge passive strategies

- Ag meets relative value analysis

- Control maximizes target returns

The growing list of data-seeking stakeholders will change some of the historical relationships between owners, tenants and managers. Increased transparency will drive behavior changes and increase competition for capital. The ability to compare what different managers are doing and the results that those managers are achieving makes for a more level playing field from the investors’ point of view.

The passive model shown in red faces the most substantial challenges. The traditional light touch oversight that owners have exercised is almost certainly going to have to become less light touch. Information delivery requirements in leases will become stricter and this will likely drive new technology adoption at the farm level to comply most cost-effectively with these requirements. As an owner, you’re responsible and liable for what happens on the farm - increasingly accountability matters.

Align for the future

Getting your strategy and tactics right today will serve you well in the future. The money, markets, safety, environmental, and efficiency themes that underpin new information requirements are in line with those associated with other production industries; they facilitate access to markets and allow access to capital while also ensuring superior risk management. Over time, they are likely to continue to become more critical, particularly with carbon-positive agriculture and new markets related to carbon credits.

"To be prepared for the future, you really need a high-level of integration between what’s happening at the executive and operational levels.”

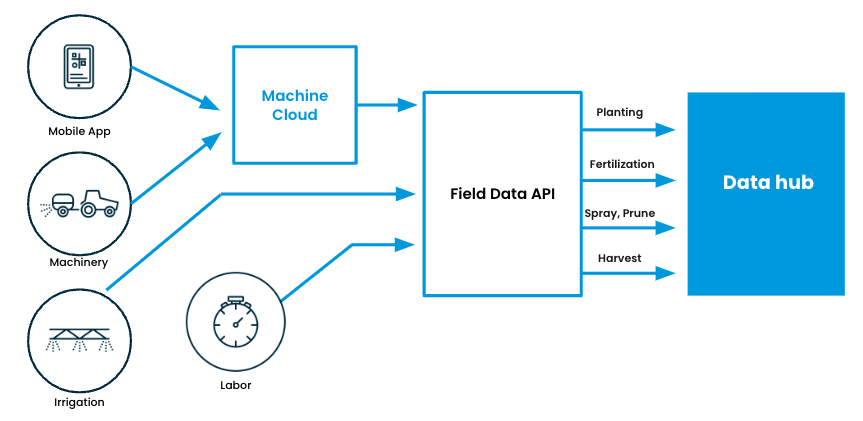

Capturing what, where, when and how

This is a fundamental shift that needs to happen within large and small operations, but particularly within the corporate farms. The range of activities that need to be captured is extensive and the list grows: emissions, fuel usage, irrigation and chemicals - how much are you using, what are you spraying, what prescription did you use, how much are you spraying? What’s the weather like and what’s the wind doing at the time of application? We are at the intersection of operational, financial and even legal risk management. This data is becoming more and more important from a compliance reporting point of view.

Getting to the future

Optimizing operations requires them to be fully integrated, and digitally consistent from top to bottom. You begin to climb the ladder from the bottom by getting your management data organized (see the chart below). Once you’re tracking budgets, purchasing, production and harvest data in a consistent manner across your operations, you are able to take the next step. From there, you develop and implement process improvements and associated key performance indicators (KPIs) that allow better management, benchmarking and profits. Ultimately, the goal here is to get to an integrated business that allows you to quickly and accurately report on all key metrics. The KPIs include financials and analytics, all the way to sustainability and people management, along with robust stakeholder reporting.

The stairway to success

Strong institutional ag business anticipate change & possess the resilience to meet future food demand.

The one certainty in agriculture is that outcomes in any season are uncertain. Maximizing performance means having close operational and financial control to manage costs and maximize yield. This develops the organizational resilience to meet future requirements by implementing an integrated, data-driven culture. Starting now means taking the first step, so you can continually move up the ladder and maintain business continuity through even the most challenging markets.